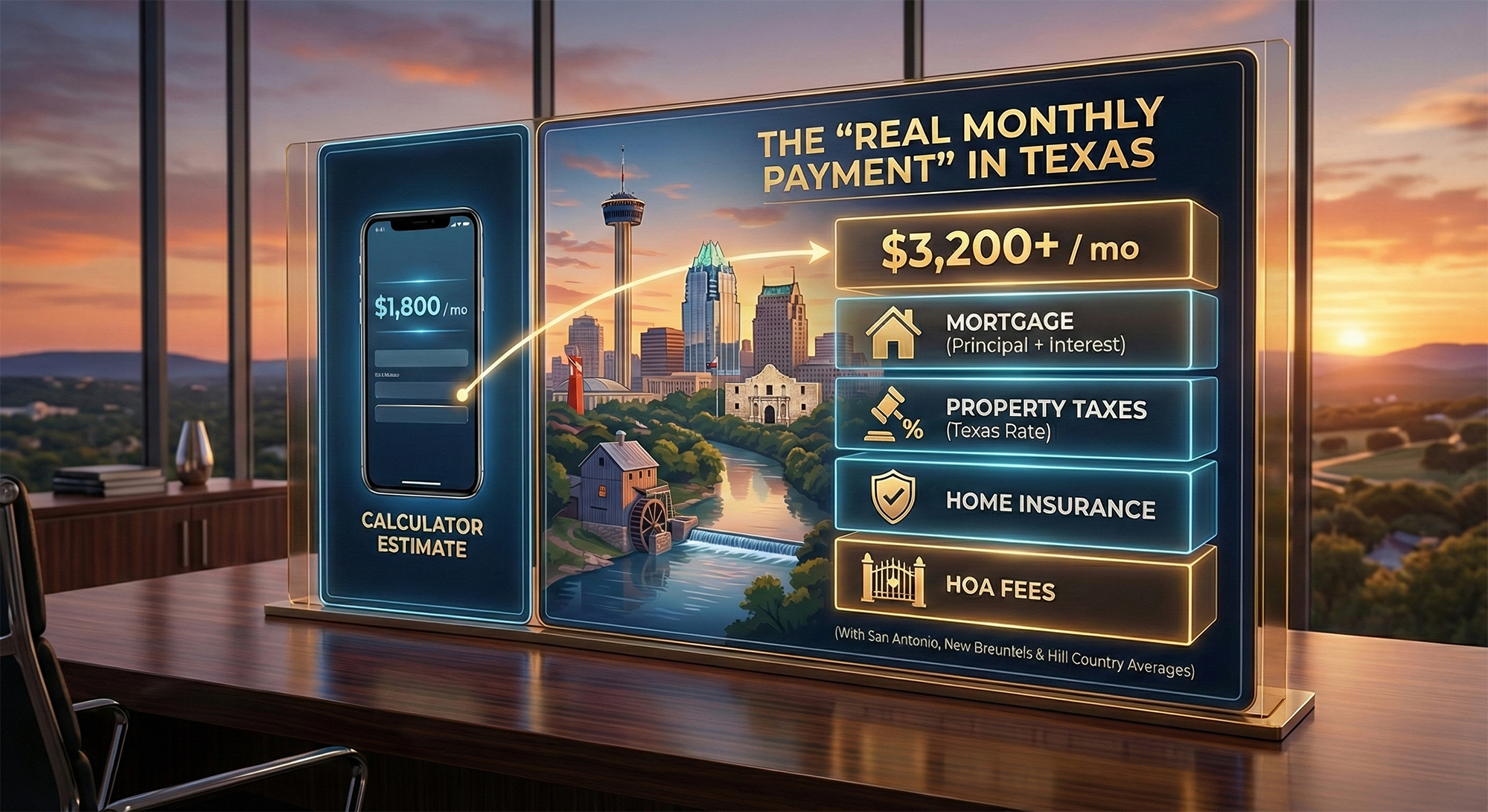

The “Real Monthly Payment” in Texas: Mortgage + Taxes + Insurance + HOA (With San Antonio, New Braunfels & Hill Country Averages)

If you’ve ever looked at a mortgage calculator and thought, “Cool—we can afford that,” then saw the lender’s estimate and went… “Wait. Why is it so much higher?” — welcome to the real world of Texas payments.

In Texas, your real monthly payment is usually:

Mortgage (Principal + Interest) + Property Taxes + Homeowners Insurance + HOA

And in the San Antonio → New Braunfels → Hill Country corridor, taxes and insurance can swing your payment by hundreds per month—even for homes at the exact same price.

1) The simple “Real Payment” formula (copy/paste)

Use this every time you’re comparing homes:

- Mortgage (P+I)

- Property taxes = (Home price × tax rate) ÷ 12

- Homeowners insurance = (annual premium) ÷ 12

- HOA = monthly dues (if applicable)

That’s the number that matters because it’s what your budget actually feels.

2) Updated property-tax assumptions for our corridor (2025 adopted rates)

There isn’t one “San Antonio tax rate” or “Hill Country tax rate.” Your total rate depends on the exact stack of County + City + ISD (and sometimes special districts like ESD/MUD/utility). The documents below are the official adopted tax-rate sheets used to build planning averages that include smaller municipalities, not just the big city line item.

Corridor planning averages you can use for budgeting

These are practical starting points for monthly payment planning across the corridor:

- San Antonio / Bexar County corridor: ~1.74%

Built from Bexar County’s published 2025 rates (county + a mix of city rates + a mix of ISD rates, including smaller municipalities shown on the same sheet). (Bexar County) - New Braunfels corridor (Comal-side + Guadalupe-side blend): ~1.81%

Built by blending Comal County’s published city/ISD rates (including City of New Braunfels, Garden Ridge, Spring Branch, etc.) with Guadalupe County’s published city/ISD rates (including Schertz, Cibolo, Marion, Santa Clara, etc.). (Comal County) - Hill Country corridor: ~1.52%

A conservative planning baseline reflecting typical Hill Country mixes where city rates can be smaller in some areas (and some homes sit outside city limits), while ISD still drives much of the total. (Your exact number can be higher in some developments due to special districts.) (Comal County)

Why the range is real: Even inside one county, city rates and ISD rates can vary meaningfully (for example, Guadalupe County’s sheet shows multiple city rates and multiple ISDs). (Guadalupe County, Texas)

Pro tip: Always ask, “What’s the ISD?” That’s often the biggest single piece of the tax stack.

3) Real monthly payment examples (same home price, different corridor tax averages)

Example assumptions (for illustration):

- 30-year fixed at 6.10% (Freddie Mac PMMS, Jan 29, 2026). (Freddie Mac)

- 20% down

- Insurance placeholder: $382/mo (Texas average estimate) (your quote will vary by ZIP, roof, claims, wind/hail, deductible, etc.) (NerdWallet)

- HOA placeholder: $76/mo (Texas median HOA/condo fee reported for homeowners who pay them)

A) $325,000 purchase (20% down)

- Loan: $260,000

- Mortgage (P+I): ≈ $1,576/mo (illustrative at 6.10%) (Freddie Mac)

Monthly taxes by corridor average

- San Antonio/Bexar @ 1.74%: ≈ $471/mo (Bexar County)

- New Braunfels corridor @ 1.81%: ≈ $490/mo (Comal County)

- Hill Country @ 1.52%: ≈ $412/mo (Texas Comptroller)

Estimated “Real Payment” (P+I + taxes + insurance + HOA)

- San Antonio/Bexar: ≈ $2,505/mo

- New Braunfels corridor: ≈ $2,524/mo

- Hill Country: ≈ $2,445/mo

B) $550,000 purchase (20% down)

- Loan: $440,000

- Mortgage (P+I): ≈ $2,666/mo (Freddie Mac)

Monthly taxes

- San Antonio/Bexar @ 1.74%: ≈ $798/mo (Bexar County)

- New Braunfels corridor @ 1.81%: ≈ $830/mo (Comal County)

- Hill Country @ 1.52%: ≈ $697/mo (Texas Comptroller)

Estimated “Real Payment”

- San Antonio/Bexar: ≈ $3,922/mo

- New Braunfels corridor: ≈ $3,954/mo

- Hill Country: ≈ $3,821/mo

C) $850,000 purchase (20% down)

- Loan: $680,000

- Mortgage (P+I): ≈ $4,121/mo (Freddie Mac)

Monthly taxes

- San Antonio/Bexar @ 1.74%: ≈ $1,232/mo (Bexar County)

- New Braunfels corridor @ 1.81%: ≈ $1,282/mo (Comal County)

- Hill Country @ 1.52%: ≈ $1,077/mo (Texas Comptroller)

Estimated “Real Payment”

- San Antonio/Bexar: ≈ $5,811/mo

- New Braunfels corridor: ≈ $5,861/mo

- Hill Country: ≈ $5,655/mo

4) The two biggest “payment surprises” in Texas

Property taxes: Texas runs high on effective rate

Texas is commonly cited around ~1.36% effective property tax rate on owner-occupied value (statewide figure), though your local stack can be higher depending on city + ISD + districts. (Tax Foundation)

Homeowners insurance: Texas is one of the higher-cost states

Insurance is extremely ZIP-code dependent, but multiple analyses show Texas among the more expensive states for homeowners insurance, and NerdWallet’s Texas estimate comes out to about $382/month on average. (NerdWallet)

5) HOA: not always huge, but it changes affordability

HOA fees are common enough that you should plan for them, especially in many newer subdivisions and master-planned communities. Texas Demographic Center reported that 34% of Texas homeowners paid HOA/condo fees in 2024 and the median among those paying was $76/month.

6) Buyer checklist: how to shop by payment (not just price)

Before you get emotionally attached to a house, get these four numbers:

- Tax estimate for that address (and confirm exemptions—especially homestead)

- Insurance quote for that specific address (roof age matters)

- HOA dues + transfer fees + any special assessments

- If it’s newer construction: compare rate buydown vs closing-cost credit (what helps more depends on how long you’ll keep the loan)

If you want, Correa Realty Group can give you a quick “Payment Reality Sheet” for your target neighborhoods (San Antonio / New Braunfels / Hill Country), using today’s rates and the correct tax stack for each address.

7) Seller note: your buyer isn’t buying a price—they’re buying a payment

When buyers filter listings, they think in monthly payment. If your home’s tax/insurance/HOA stack pushes the payment above nearby alternatives, you may see:

- fewer showings

- more price reductions

- more requests for concessions (closing costs, repairs, rate buydown)

A smart seller strategy today is to market the payment-friendly advantages (lower HOA, transferable warranties, newer roof, etc.) as aggressively as the granite and the pool.

Bottom line: In Texas, the “real payment” is rarely just the mortgage—taxes, insurance, and HOA often determine what’s truly comfortable month-to-month. If you’re buying or selling anywhere in the San Antonio → New Braunfels → Hill Country corridor, Correa Realty Group can run a fast, address-specific Payment Reality Sheet (tax stack + insurance ballpark + HOA details) so you can shop—and price—based on what matters most: the monthly number.

FAQ (high-intent SEO)

What is PITI in Texas?

PITI is principal, interest, taxes, and insurance. In Texas, taxes and insurance can be a larger portion of the monthly total than many buyers expect. (Tax Foundation)

What’s a “good” tax rate around San Antonio or New Braunfels?

There’s no single rate—your total depends on county + city + ISD + districts. Use corridor planning averages as a starting point, then confirm the exact stack for the address. (Bexar County)

Do HOA dues affect what I qualify for?

Yes—lenders count HOA dues in your debt-to-income ratio, which can reduce the home price you qualify for.