Property Taxes in Bexar/Comal/Guadalupe: How to Estimate Your Payment (and Avoid Escrow Shock)

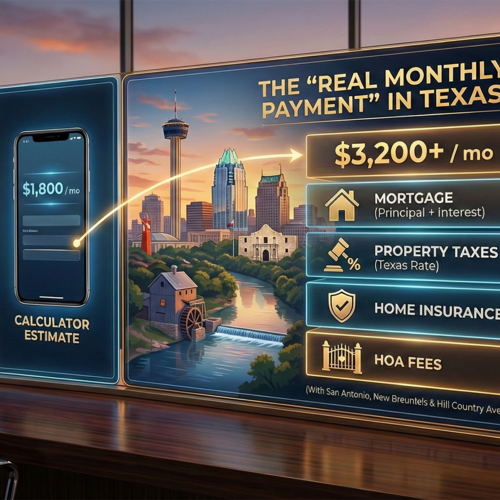

If you’ve ever heard someone say, “My mortgage didn’t change… but my payment jumped,” it usually comes down to property taxes and escrow.

In the San Antonio → New Braunfels corridor, the most common “payment surprise” looks like this:

- Your lender estimated taxes using a prior value, missing exemptions, or a simplified rate

- Your first real tax bill comes in higher

- Your servicer runs an escrow analysis and raises your payment to catch up (sometimes plus an extra amount to rebuild the escrow cushion)

The good news: you can estimate taxes accurately enough to budget confidently—and avoid escrow shock—if you follow a simple process.

Step 1: Know what you’re actually estimating

Your yearly property tax bill is based on:

Taxable Value × Total Tax Rate

- Taxable value = appraised value minus exemptions (homestead, over-65, disabled, etc.). (Texas Comptroller)

- Total tax rate is a stack of multiple taxing units (county, city, school district, and often special districts).

Most online “quick calculators” underestimate because they don’t include the full stack—or they don’t match your specific address.

Step 2: Build the “total tax rate stack” for your address

Tax rates in Texas are commonly shown as dollars per $100 of value (example: 1.0049 = $1.0049 per $100).

Below are real 2025 adopted rate examples from each county’s published tax-rate sheets, so you can see how the stack works.

Example A — Bexar County (San Antonio address in Northside ISD)

From Bexar County’s 2025 official rate sheet, a common stack can include:

- Bexar County: 0.276331

- City of San Antonio: 0.541590

- Northside ISD: 1.004900

…and additional common lines on the same sheet such as: - Alamo Community College: 0.149150

- Hospital District: 0.276235

- Road & Flood Control: 0.023668

- SA River Authority: 0.018300

✅ Illustrative total (added together): ~2.29 per $100 = ~2.29%

Why this matters: if you only budget for “county + school,” you can be off by hundreds per month.

Example B — Comal County (New Braunfels address, Comal ISD)

From Comal County’s 2025 tax rate PDF:

- Comal County: 0.269000 (comalcounty.gov)

- Comal County Lateral Road: 0.036015 (comalcounty.gov)

- City of New Braunfels: 0.408936 (comalcounty.gov)

- Comal ISD: 1.074800 (comalcounty.gov)

✅ Illustrative total: ~1.79 per $100 = ~1.79% (comalcounty.gov)

Example C — Guadalupe County (Schertz address, Schertz-Cibolo-UC ISD)

From Guadalupe County’s 2025 tax rate sheet:

- Guadalupe County: 0.2784

- Lateral Roads: 0.052

- City of Schertz: 0.5118

- Schertz-Cibolo-UC ISD (listed as “Schertz ISD”): 1.0769

✅ Illustrative total: ~1.92 per $100 = ~1.92%

Watch-outs in Guadalupe: The same sheet shows water districts and MUDs (some are big). That’s how two nearby homes can have very different tax totals.

Step 3: Estimate your taxable value (and don’t forget exemptions)

The big one: homestead exemption

Most exemptions require an application with your appraisal district, and the general filing deadline is before May 1. (Texas Comptroller)

If your homestead exemption isn’t applied yet, your taxable value can be higher than you expect—especially on the school tax portion.

Step 4: Convert to a monthly estimate

Quick math

Annual taxes = (Taxable Value ÷ 100) × (Total rate per $100)

Monthly escrow estimate = Annual taxes ÷ 12

Example (simple):

- Taxable value: $400,000

- Total rate: 1.90 per $100

Annual taxes = (400,000 ÷ 100) × 1.90 = 4,000 × 1.90 = $7,600/year

Monthly = $633/month

Why “escrow shock” happens (and how to avoid it)

Mortgage servicers are required to run an escrow account analysis to determine if there’s a shortage, deficiency, or surplus, and then adjust your payment accordingly. (Consumer Financial Protection Bureau)

Escrow shock usually comes from one (or more) of these:

- Taxes were estimated too low at closing (common on recent sales or new builds)

- Homestead exemption wasn’t applied yet (so taxable value is temporarily higher) (Texas Comptroller)

- A special district (MUD/WCID/ESD) was missed in the estimate

- Rates change after the year’s budgets are adopted (your bill is finalized later in the year)

6 ways to avoid escrow shock

- Ask for the full tax stack before you buy (county + city + ISD + special districts).

- Budget using a conservative taxable value (especially if you’re buying a home that hasn’t been sold in years).

- File the homestead exemption ASAP after closing (and confirm it shows on your account). (Texas Comptroller)

- Keep a 2–3 month tax buffer in savings the first year.

- Read your escrow analysis letter and check the tax amount they’re using (don’t assume it’s right). (Consumer Financial Protection Bureau)

- Know the protest window if your value notice looks inflated: typically May 15 or 30 days after your Notice of Appraised Value, whichever is later. (Texas Comptroller)

Don’t ignore deadlines (they cost real money)

If taxes become delinquent, penalties and interest begin Feb. 1 (in many cases), and the Comptroller outlines how those penalties accrue. (Texas Comptroller)

Wrap-up: We’ll help you estimate taxes the right way

Property taxes in Bexar, Comal, and Guadalupe aren’t one-size-fits-all—your bill depends on the exact address stack (county + city + ISD + districts) and whether exemptions are applied. If you want a clean, address-specific estimate before you buy—or you’re trying to price a listing with the buyer’s monthly payment in mind—Correa Realty Group can prepare a quick Tax + Payment Reality Sheet so you can move forward with fewer surprises and a lot more confidence.